Stealth Financing – Part 1

In September / October 2022, the following was published on our LinkedIn sites:

Around November of last year (2021 – time of first publication of this article was in 2022), I purchased shares in a listed South African company named Distell. At the time Heineken had put in an offer to purchase * the company and buyout existing shareholders, at a premium to its existing share price.

Now purchasing shares obviously comes with risk, as does the expected timeline of a takeover bid, particularly when a listed entity is involved. In theory this was a relatively low risk purchase. A large multinational with a healthy balance sheet was acquiring a company with strong fundamentals and in a solid financial position, despite setbacks during the COVID lockdowns.

I could hold onto the share until the buyout was finalised in the next 7 to 8 months, perhaps receive a dividend during that period or sell the share beforehand at a profit. As the deadline approached, a delay was announced, the timeline would be longer than expected. A condition of the final buyout was that no dividends would be declared or paid out post the offer being accepted. Shareholders, whilst not happy with the situation, could accept this if the timeline remained relatively unchanged.

However, it became clear that the delay would add at least 6 months to the timeline. The existing shareholders were effectively going to partly finance the purchase of their own shares! As the selling price is fixed and no dividends are going to be declared, Heineken will effectively be receiving free financing from the existing shareholders for each passing month ….

As the payout of the purchase is being delayed, Heineken likely (depending on the terms of how they were financing the deal) will not have to pay financing costs or lose interest income for at least 6 months post the initial timeline, given the rampant inflation at the moment, the fixed purchase price is reducing in real terms even more rapidly than would normally have been the case, this delay and no further dividends is a double whammy for existing shareholders.

Now whilst this could not have been intended, Heineken would obviously prefer to get the purchase finalised and out of the way. They would not want the ongoing distraction of the purchase and would prefer to start implementing their plans for Distell, realising the expected synergies and growth.

That said unless an additional dividend were to be declared or the purchase price increased, the reality would seem that a form of Silent or Stealth Financing will be taking place, at the expense of existing shareholders.

Do Heineken need to reimburse existing shareholders for this delay …. probably not, should they …. it would be the “right thing to do”, if the interests of all stakeholders were to be considered.

Part 2 to this article, “Leveraged Buyouts” to follow later this week as we further explore the pitfalls of having the incorrect mix of Financing and Funding of a business, both from a financial health and an ethical point of view.

PS. I sold the shares a few months ago at a small profit (in absolute terms) when the delay was announced, at this point I am an interested observer.

*Additional detail added (18/02/2023)

Distell buyout by Heineken – a high level view of the timeline:

November 2021 intention to acquire communicated.

Initial Circular at the beginning of 2022 – expected completion and payment date July / August 2022.

June 2022, oops the expected regulatory approval unlikely to be received by June 2022, …. don’t worry …. we still expect the implementation of the scheme to be completed in 2022.

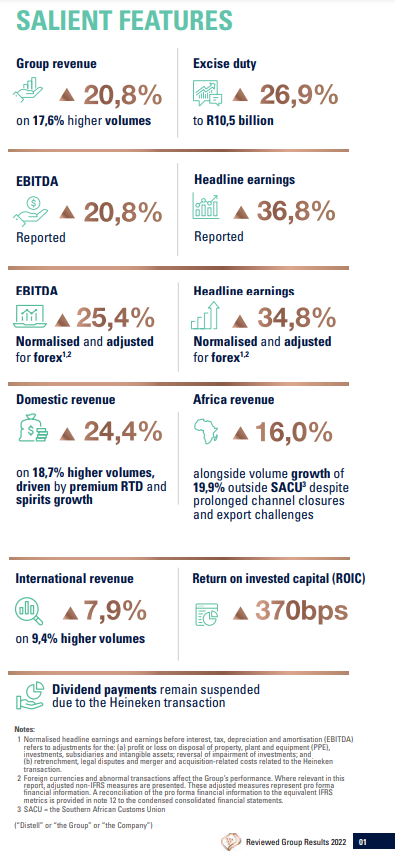

Extract from the Sens Announcement, for the 2022 Financial Year-end (decent results):

“ https://www.distell.co.za/investor-centre/financial-results/DGHFY22.pdf “

First half of September 2022 …. The Competition Commission recommends that the Heineken buyout of SA’s largest alcohol producer, Distell, go ahead with conditions. The

Competition Tribunal has determined that its hearing to consider the Transaction will be held on 18 to 20 January 2023.

Expected payout date to the existing shareholders still not known, clearly it won’t be in 2022.

SENS announcement – Listed companies in South Africa are required to announce and publish material updates, 10 February 2023 .

“Accordingly, the expected important dates and times relating to the Transaction, as published on Wednesday, 18 January 2023 in the 2023 Newco Prospectus and accompanying SENS announcement, will change and the Transaction Update Announcement will not be released today, Friday, 10 February 2023, as indicated.”

Net result, shareholders hadn’t been paid the proposed purchase price or a dividend since the date of the original proposed buyout in November 2021.

Part 2, “Stealth Financing, when it Shouts” to follow.

#thecrazyaccountant #root4plant #E&OE

Don’t forget to sign up to our Newsletter.

Disclaimer

Once again as is always the case any information, content, article, post or Blog is not intended nor does it constitute financial, tax, legal, investment, or other advice. We are here to encourage debate and interest in Financial Education and Finance related matters. Everyone / entity has different needs, risks, is at different stages of their life or development, every geographical location has its own laws and regulations, as such consult with a suitably Qualified Financial Advisor who can assist and advise you based on your circumstances and requirements.

Any decisions you make after reading a blog post or other information are your responsibility and we cannot be held liable for anything you choose to do. Any reliance you place on such material is therefore strictly at your own risk.